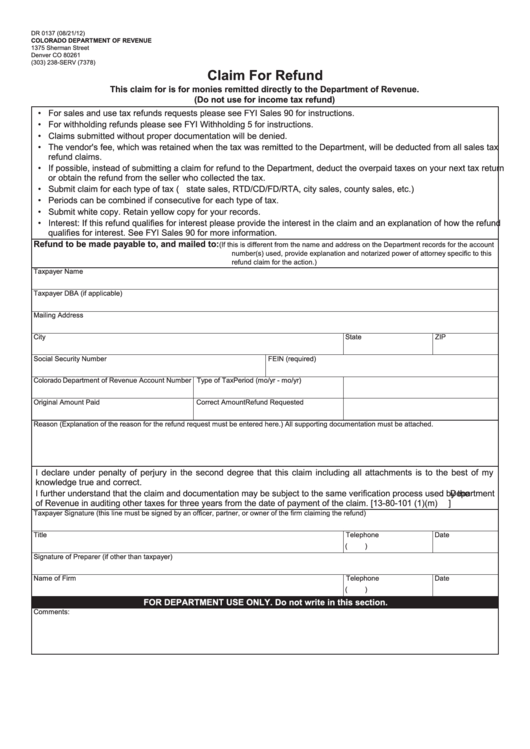

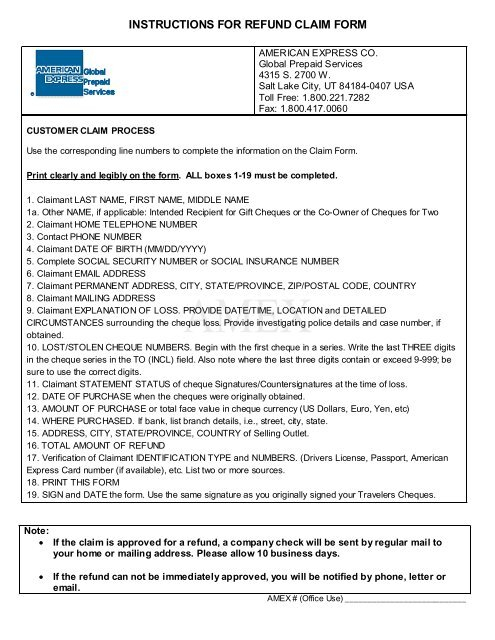

Revenue And Taxation Code Refund Claim Form – A return form is a piece of paper that allows customers to request cancellation of their purchase or service. In general, it requires the buyer to provide certain information, such as their name, contact details in addition to the order’s number. motive for the request.

Why Fill Out a Refund Form?

Inputting in a refund request form is essential to guarantee the refund process is conducted efficiently and swiftly. In completing all of the necessary information included on your form you’ll help the company determine your needs more quickly and enable them to process the request more promptly as well.

Top Tips for Filling Out a Refund Form

- Gather all the relevant information prior to filling out the form

- Read the instructions carefully to make sure you provide all required information

- Be clear and concise when explaining why you are in need of a refund.

- Make sure you have all the correct information before inputting the form

Step-by-Step Guide to Filling Out a Refund Form

- Be sure to read all instructions thoroughly and keep all information you need.

- Fill out customer information like the name, contact number and the order number.

- Give a thorough and specific justification for why you’d benefit from a refund or business, along with any necessary documents. Make sure you double-check all information prior to sending the form!

- Common Errors to Avoid When Serving Out a Refund Form

- Incomplete or incorrect information

- Do not include all the required documentation

- Being unclear or vague in your explanation of why you would like a refund request

- Refusing to accept the request for refund completely

- Form submission without double-checking to ensure there are no errors

Additional Information to Include on Your Refund Form

Depending on the item or service you bought, you will likely need to add any additional information along with your refund request. This can include things such as:

- A proof of investment such as a ticket or order confirmation

- Videos or photos of the product if they are any defects or damage that need to be repaired.

- Warranty information related to both products and services

- Can You Keep Track of Every Conversation Related to the Refund Request?

How Long Will it Take for You to Receive Your Refund?

The length of time that it takes to get your refund will vary based on the policies and procedures. Typically, it takes anywhere from a few days in the beginning to a period of several weeks for the refund to be processed and issued. If you’re concerned or issues regarding this period, be sure to reach directly to their customer services department for clarification.

The final step is to fill out your refund request can be easy if do the right thing and supply all necessary information. By keeping away from common mistakes and providing all additional documentation will help ensure your refund is processed speedily as well as accurately. If you’re struggling with questions or problems in this time, don’t hesitate to contact the customer service department at the company to get assistance.